This analysis tries to answer the question:

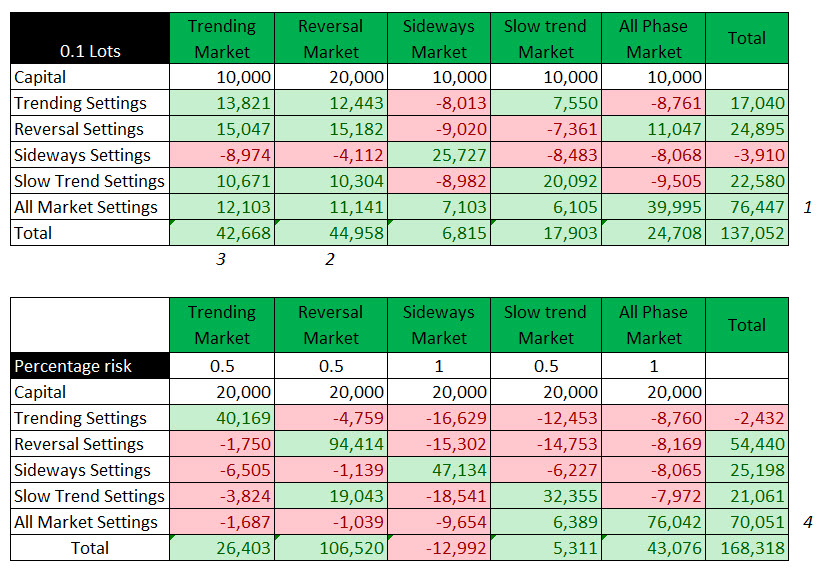

What happens if I use the wrong settings in the wrong market?

Below is an analysis of current optimised settings for a specific market being used in market that they are not intended to be used.

It also makes a differentiation between trading fixed lots and % of equity results.

Initial observations

- The general market setting were positive in all market types when using the fixed lot sizing approach

- The trending markets produced good results using all settings except when sideways market settings were used

- The Reversal markets produced good results using all settings except when sideways market settings were used

- The all Market settings were the most robust when using the % risk approach

- Sideways optimised settings only worked in sideways markets. Sideways market results need to be risk controlled. EA improvement 3 will help in this area.

IMPACT ON INVESTMENT OPTIONS

Option 1 uses the All market settings with % of equity settings which according to this analysis provides the 2nd best and robust results.

Option 2 uses the All market settings with fixed lot sizing which according to this analysis provides the best and robust results.

Option 1 uses the All market settings with % of equity settings which according to this analysis provides the 2nd best and robust results.

Sideways market are a clear threat and closing all deals when overall positive maybe the answer to reducing sideway market risk